How sustainable is the Business strategy of Rolls Royce Motor Car Company? [Report]

January 13, 2022 2022-01-14 13:51How sustainable is the Business strategy of Rolls Royce Motor Car Company? [Report]

How sustainable is the Business strategy of Rolls Royce Motor Car Company? [Report]

Need a paper like this one? Order one via the form or email on our homepage.

Executive Summary

This paper intends to give an analysis of the strategic direction that the Rolls-Royce Motor Cars Company has taken in order to attain and retain the desirable market share (customers with more than $30 million in liquid assets) for its cars in the United Kingdom. In order to establish the strategic position of the firm, the paper employs the following strategies; PESTEL analysis, the Porter’s five forces of the market, SWOT analysis, and Porter’s three generic strategies.

The analysis done in the paper reveals that the market for cars produced by the Rolls-Royce Group faces a tight market in the United Kingdom. The market is shared by seven large-volume car manufacturers and eight high-end sport car manufacturers. The market is, therefore, competitive. However, the group has managed to affirm its top position in United Kingdom. According to the sales report in 2013 it was at the top in the luxury-goods manufacturing and still recorded the highest sales record ever. The major attribution to this is through focus strategy, especially under the new brand of luxury cars christened “Ghost”. Through the production of luxury cars, the firm has affirmed its position as a luxury-goods production leader. The success is more than it would have attained through its other strategic business units such as the production of airline engines.

The paper also gives suggestions on retaining the competitive edge in the UK while still eyeing the global market. Some of the opportunities to be exploited are: greater diversification of the brand portfolio and still charge premium prices, transition towards embracing the low-carbon future such as the production of electric cars, and closing in on the gap between test performance and real-world performance. Additionally, the firm needs to endeavor on retaining the luxury vehicle niche leadership in the United Kingdom. These recommendations will place Rolls-Royce Motor Cars Company on a better competitive platform than it is now.

1. Introduction

The Rolls-Royce brand was started in 1904 under the company Rolls-Royce Limited. However, the Rolls Royce Motor Car Company was established in 1998 as a fully owned subsidiary of the BMW AG group. This was after BMW AG was granted rights to use the Rolls Royce brand name and logo by the Rolls-Royce group plc; a group that was formed after a split of Rolls-Royce Limited. The Rolls-Royce Motor Car Company commenced the design, manufacture and distribution of luxury automobiles in the year 2003. To date, it deals exclusively with the manufacturer of Rolls-Royce branded automobiles christened: Ghost, Phantom and Wraith. These cars are targeted at the super-rich niche whose demand has been dynamic and unpredictable (BBC news, 2007). It is, however, imperative to note that the Rolls-Royce Motor Car company has no relationship with Rolls-Royce branded cars produced before 1998 (BMW Group, 2014).

In the context of the UK super-luxury automobile market, this paper seeks to analyse the business strategy taken by the Rolls-Royce Motor Car Company. The paper, in the structure of a report, will analyse the environmental factors, internal and external, and their implications on the competitiveness of the company in the automobile manufacture and distribution industry. Moreover, the paper will make recommendations on the current business strategy being employed by the company. To achieve this, the paper applies business analysis strategies which include the PESTEL analysis, Porter’s five forces of the market, Value chain analysis, SWOT analysis and Porter’s three generic strategies.

2. External Environment analysis

A firm operates within a framework of environmental forces, the major force being the uncontrollable macro environment. “Any business that is not aware of its environment is bound to run into some crises” (Babatunde and Adebisi, 2012, p.26). Also, every component of the macro environment has an impact whether massive or frail on the company’s strategy (Cherunilam, 2010). The following is a macro environment analysis for the Rolls-Royce Motor Car company using PESTEL analysis.

2.1. PESTEL ANALYSIS

2.1.1. The political environment

Being a domestic company, the Rolls-Royce Motor Car company enjoys subsidies and incentives given to local companies investing locally; the government’s vision is in congruence with the desire to excel by local firms. To this end, the government once redirected lending towards the home market (Baldwin and Evenet, 2011), and has invested over 500 million pounds aiming at production of low-carbon emitting automobiles (Gauay, 2011). The UK government enjoys political stability and sound relations with neighboring nations. The result is an enabling environment for businesses. In the UK large firms face pressure from customers, regulators (such as the government) and communities to observe positive environmental practices through job creation and community engagement programs (Brammar, Hoejmose and Marchant, 2011). The firm is also required by the government to ensure environmental responsibility and product safety in general.

2.1.2. Economic environment

The Rolls-Royce Motor Cars company’s production end faces problems as factors employed are becoming expensive by the day. Labor costs are on the rise, costs of materials such as latex, silica, fabricate glass, platinum et cetera. Government taxes on the sale and registration of motor vehicle are high compared to other European Union (EU) nations and this also presents the pricing challenge (Sperling and Kurani, 2003; Wiley-Blackwell, 2013). Regardless, the UK economy has stabilized since plummeting in 2008 and has obtained a significant command over economies of EU member states. The stable economy is a contributing factor to the firm’s historical sales record set in 2013 when it sold over 3,630 automobiles (Cervi, 2014).

2.1.3. Social-cultural factors

The target market for Rolls-Royce Motor Car is the elite group. The niche does not change much because mostly it is composed of families that are super-rich. According to Munkad (2007), to such people, a Roll-Royce automobile is simply pocket change. They make 1% of the population and control over 25% of the market wealth with earnings of over 220,000 pounds a year (Pabst, 2012). A study on income and wealth distribution in the UK found that income is equally distributed whilst wealth is not. The wealthiest 10% of the households is more than a hundred times wealthier than the bottom 10% (Gentleman and Mulholland, 2010). The result is that the possibility of target market for super luxury goods – which are for the wealthy – expanding grows slim.

Figure 1: Wealth distribution chart for the United Kingdom (Office of National Statistics, 2012).

2.1.4. Technological

The modern consumer, through the use of the internet, has more knowledge and power. According to Starbuck (2014) Mobile phones have been the most innovative technology and have spread and changed enough to be socially transformative. Consequentially, it is prudent for firms to invest in digital platforms to stay at par with the consumer technology trends. The internet also provides a fast and cheap advertising tool; a report by Euromonitor International shows an increase in 47.5% on online advert expenditures in the UK since 2007 and points out at the UK e-commerce industry as the largest in Europe (Euromonitor International, 2013). Firms, such as the Rolls Royce Motor Car Company, are therefore facing a great opportunity in exploiting the internet as a platform to reach out to their customers.

2.1.5. Legal environment

The UK has laws and policies that protect consumers. Consumer protection bodies like the Office of Fair trading enforce such laws and policies. Through these bodies and the laws they implement, such as the Enterprise Act, consumers can file safety and health complaints against businesses. This means firms under the tourism industry need to ensure quality standards are met to avoid legal liabilities to their customers. Apart from consumer protection, there are policies on trade as under the Fair Trading Act that governs competition and business strategies like mergers or acquisitions (Furse, 2008). Additionally, there are various policies that have emerged to facilitate the low carbon requirements by the year 2020. For example, the European Emissions Trading Scheme (EU ETS) now prohibits free issue of greenhouse gases emission permits. The scope of EU ETS was expanded, as of 2013, to cover heavy production industries dealing with chemicals and metals (Ahner and Meeus, 2011). All these policies create a strict operating environment for firms such as Rolls Royce that run industries producing greenhouse gases and other toxic wastes.

2.2. PORTER’S FIVE FORCES

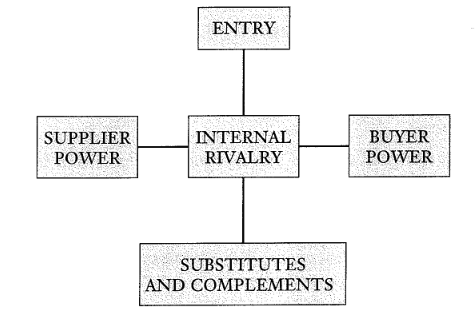

Porter’s five forces is a framework that is used in analysing and understanding the forces that shape competition in a market. According to Michael Porter, the five forces include threat of new entrants to the industry, threat of substitutes, internal rivalry (competition) among existing firms, bargaining power of suppliers and the bargaining power of buyers (McGuigan and Moyer, 2010).

Figure 2: An illustration of Porter’s five forces model (Besanko, 2013)

2.2.1. Bargaining power of buyers

The bargaining power of buyers for UK’s super-luxury car industry is low. Firstly, the target market is not large as compared to that of conventional automobiles – the typical customers are those with ultra-rich net worth of over $30 million a year or high-net worth of over $5 million a year (Pagano, 2014). The result is that the producers of these cars are few and accordingly, the customer has a few alternatives to choose from. Another fundamental point of note is that the switching costs from one brand to another are high because it is hard to find a substitute with similar quality, specifications and features. In general, the customer has little or no leverage of taking the lead against the manufacturer in terms of prices.

2.2.2. Supplier bargaining power

The bargaining power of suppliers in the UK is high for dealing with super-luxury car manufacturers. One major reason to this is because the kind of materials that are used to manufacturer a luxury car such as a Rolls-Royce automobile are of high quality and the supplier needs to meet quality standards. Rolls-Royce Motor Car Company, for example, has a Bespoke program that allows buyers to customise their cars – interiors and exteriors – and this creates need for high quality and exclusive materials such as leather, wood and diamonds (Singh, 2014). Suppliers who are able to attain such quality levels are few and the company therefore would experience large switching costs moving from one supplier to another. Again, in order to maintain and further the prestige and exclusiveness of the Rolls-Royce brand to the UK, the company cannot outsource services as conventional car manufacturers do (Weldon, 2014).

2.2.3. Competitive power of rivals

The UK is well known as a home to the best luxury car manufacturers in the world. In the domestic market, the competitive rivalry between luxury car manufacturers is high as they strive to get hold of a better market share. The parent company to Rolls-Royce Motor Car Company, BMW, as of January 2013 held 4.4% of the market-share (The Telegraph, 2014). The subsidiary also ranked among the top brands against Bentley Motors, Land rover, Jaguar and Mercedes Benz. Bentley Motors has been the major competitor often recording better sales. For example in 2011, Bentley sold over 7,000 cars which was an increase of 37% from the previous year (Madslien, 2012).

2.2.4. Threat of substitutes

Fundamentally, important here is the ability of competitors offering substitutes to what the firm is offering. The threat of substitutes to models under Rolls Royce in the United Kingdom is low because the available substitute models are few such as Aston Martin, Mercedes Benz, Bentley, Lamborghini and other luxury car models. Additionally the cost of switching from one automobile manufacturer to another is high given that the unique features of a particular car or car manufacturer may not be found in other models. Such high switching costs, ass attributed to distinguishing features, offer a firm leverage to charge premium prices (Rhodes, 2014). Also advantageous to Rolls-Royce Motor Car Company is the customer loyalty to the Rolls-Royce brand that has been around for more than a hundred and ten years (BMW group, 2014).

2.2.5. Threat of new entrants

Competitive power is also influenced by the ability of new investors coming into the market. In reference to the automobile industry in general, the costs associated with establishing and developing a car brand are enormous. Although government seems keen in offering incentives to the automobile industry, they are directed towards supporting infrastructure and not direct subsidies and are thus not enough to enable new companies entry into super-luxury car production (Business Monitor International, 2014). The only chance of new entry is when the current players decide to shift or diversify towards production of super-luxury cars (Gilbert, Geroski and Jacquemin, 2013). Consequently, the threat of new entrants is low.

3. Internal environment analysis

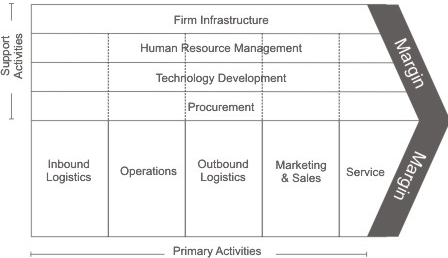

To address this, value chain analysis is essential. The value chain structure comprises of interdependent activities that are connected by linkages. The linkages, if managed well, can be a vital ingredient towards attaining competitive advantage.

Figure 3: The primary and secondary activities In Value Chain Analysis (Ireland, Hoskisson and Hitt, 2008)

The Rolls-Royce Motor Car Company employs more than one thousand four hundred people who cater for the diverse client needs at the Goodwood factory such as handcrafting the interiors. The firm also boasts of low staff turnover as evidenced among the 80% of its employees living within a few miles of the factor and the entire manufacturing industry (Rolls Royce Motor Cars, 2014b). Again, the firm invests in the future talent through internship, graduate trainees and apprenticeship programs. Consequently, the handling of materials and processes is top notch. One drawback, though, is that the skilled labor force and quality cars result in a high cost structure.

Rolls-Royce brand image is strong and has an aspirational value to customers. This does, in turn, make sales and marketing easier because the customers already associate the brand with quality and prestige. However the brand is associated with the super rich only and other low and middle income earners shy away from buying such expensive cars (Maguire, 2013).

The firm has a production plant in the Goodwood, United Kingdom and has a good supply network. A drawback to the good distribution is the time needed in production. Currently, the firm has embraced production of customised cars through their Bespoke program. Therefore, Rolls-Royce cars are produced much slower, and this means the time the customer waits between placing an order and the delivery is long; up to six months (Rolls Royce Motor Cars, 2014b). In terms of marketing, the firm has made use of viral marketing on social media to target young people. According to The telegraph, customers taking “selfies” with the cars and posting them on social media was a priceless marketing tool (Singh, 2014).

An area of concern for Rolls-Royce Motor Car Company is the rising cost of raw materials. Manufacturing industries in the UK are being forced to rely on squeezed profits due to rising production costs (Harvey, 2014).

4. SWOT Analysis

4.1. The strengths of Rolls Royce Motor Car Company

The Rolls-Royce Motor Car Company is a wholly-owned subsidiary of the BMW group and it therefore receives technological assistance from the latter. Rolls-Royce Motor Car Company relies on a strong brand image in the United Kingdom that it has maintained for a long time and due to such an image, the automobile firm has created an aspiration by many customers.

The cars made by the firm are quality and customized according to customer preferences. Brands such as Phantom (Phantom Drophead Coupé), a convertible automobile, and the re-invented Ghost brand have excelled meeting customer preferences though personalization (Rolls-Royce Motor Cars, 2014a). The brands are therefore premium and appealing to the elite niche of the UK, and consequently the brands represent one of the few significant class symbols of the fabulous and rich. Additionally, the Bespoke program in Rolls Royce Motor Car Company has enabled the company to find a Roll-Royce-branded-cars’ market among the young and wealthy (Singh, 2014).

4.2. The Weaknesses of Rolls Royce Motor Cars Company

A major weakness for Rolls-Royce Motor Cars Company is the high cost structure it operates. The firm has ventured into customisation of cars where most of the work is done manually (Roll Royce Motor Cars, 2014b). For example, leather seats are handcrafted and designers have to take time to attend to the unique needs of each client. The firm also applies skilled labor which adds to the costs (Singh, 2014). Consequently, total production costs are high.

4.3. The Opportunities for Rolls Royce Motor Cars Company

As aforementioned, the major concern in the automobile industry is shifting towards environmental friendly automobiles. The luxury niche also needs this, and it is, therefore, an opportunity for Rolls-Royce Motor Car Company to expand to as it strive to retain the market share (Society of Motor Manufacturers and Traders, 2014). Another trend that auto manufacturers are utilising involves reducing labour costs and altering labour contracts in the European markets to boost competitiveness. The Rolls Royce Motor Car Company therefore has an opportunity to take advantage of flexible working hours, employment contracts and wages offered by the now open-to-negotiations labour unions in the European markets (Business Monitor International, 2014). Flexible labour means a company such as Roll Royce Motor Car Company, which is labour intensive, can lower operating costs and respond to changing market dynamics easily.

4.4. The threats of Rolls Royce Motor Cars Company

There are more than forty-two automobile manufacturers in the United Kingdom and more than eight of these firms focus in manufacturer of luxury brands. The firm is thus faced by stiff competition from companies like Bentley, Aston martin, Mercedez Benz and Jaguar. There is also the threat of rising costs of raw materials in the UK which impacts on profits (Harvey, 2014).

5. Porter’s Generic strategies

When basing on the generic strategies by Michael Porter, it is easy to identify that the firm employs differentiation focus strategy for its market. The firm has capitalised on the differentiation focus strategy by targeting the super-rich niche. The target market for its brands is the small group of the super-rich individuals in the UK and around the world (owning more than $30 million in liquid assets) (Mankard, 2007). The firm then produces premium priced automobiles that suit that market segment. According to Sehgal (2010, pp. 37), “customers pay a premium price for products only when they perceive a distinct value in its unique features”. The automobiles brands under Rolls-Royce, such as Phantom, Wraith and Ghost, have special designs and unique features, especially under the company’s Bespoke program, that appeal to the niche that the company targets. The premium prices reflect on the additional value in unique features and the prestige that is associated with the brand. It has managed to establish a loyal customer base over the years.

5.1. The future of Rolls-Royce

The main current focus strategy seems to work well with the firm. It has recorded constant improvement over the years. However, a specific area of improvement on focus strategy would be the inclusion of more brands into the three existent brands. Creating new brands that target the market would be a good way to increase market share – especially with a growing young customer base (Singh, 2014). This area is also advantageous because it is an opportunity to charge premium prices for the new brands. Additionally, the firm can choose to focus on production of more environmental friendly automobiles especially electric cars that target the same market share it has right now. It is possible to appeal to new customers even as the prices of gas continually rise.

6. Conclusion

The Rolls-Royce Motor Car Company has been an admirable manufacturer of luxury automobiles. Decisions in the firm have been largely driven by the market that it serves and the desire to expand the market. The strategies that are employed currently have been successful in helping the firm attain the best sales record ever since its inception. It has survived tough economic times such as the great economic depression of 2008. Additionally the strategies have been aimed at maintaining the appeal of the brand to the royal and the lavish. However, this has not been enough. The super-luxury automobile market in the United Kingdom is composed of many producers. As per the SWOT analysis, the opportunities and weaknesses of the firms are apparent. The firm, therefore, needs an improvement on the focus strategy to stand on a better platform to compete with a major rival like Bentley.

The opportunities available include expanding the brand portfolio by creating new brands that appeal to the growing young customer base (Singh, 2014). The parent company, BMW, also has failed in this facet of brand portfolio. The subsidiary current three brands; Phantom, Ghost and Wraith, seem to underutilize the strong brand image of Rolls-Royce. The area of environmental friendly automobiles is unexploited for the kind of market the firm targets. It can embrace the opportunity to create new brands of electric cars, coupled with features such as automated and real-time traffic navigation (Society of Motor Manufacturers and Traders, 2014), Geo fencing capabilities, et cetera. The other suggestion is to make use of the government incentives to suppliers to cut costs of production while maintaining prices. This will increase the profit margin. It is conclusive to say the Rolls-Royce has had a successful existence since 1998, but through more investment into the aforementioned improvements, it can perform even better in the years to come.

7. List of references

Baldwin, R. and Evenett, S. (2011). The collapse of global trade, murky protectionism, and the crisis. London: Centre for Economic Policy Research.

BMW group, (2014). Milestones. [online] Available at: http://www.bmwgroup.com/e/0_0_www_bmwgroup_com/unternehmen/historie/meilensteine/meilensteine.html [Accessed 7 Nov. 2014].

BMW group, (2014). BMW Group : Brands : Rolls-Royce Motor Cars. [online] Available at: http://www.bmwgroup.com/com/en/brands/rolls-royce-motor-cars.html [Accessed 7 Nov. 2014].

Cherunilam, F. (2010). Elements of Business Environment. New Delhi: Himalaya Pub. House.

Doede, K. (2013). Management: A European Perspective. 2nd ed. London, United Kingdom: Routledge.

Furse, M. (2008). Competition law of the EC and UK. Oxford: Oxford University Press.

Gaskarth, J. (2013). British foreign policy. Cambridge: Polity.

Gauãÿ, P. (2011). The Electric Car and Britain. Britain: GRIN Verlag.

Geroski, P., Gilbert, R. and Jacquemin, A. (2013). Barriers to entry and strategic competition. 5th ed. Chur, Switzerland: Taylor & Francis.

Harvey, F. (2014). Manufacturers urge action over raw metal prices amid supply worries. [online] the Guardian. Available at: http://www.theguardian.com/environment/2014/jul/08/raw-metal-prices-warning-uk-manufacturers-volatility [Accessed 7 Nov. 2014].

Hill, C. and Jones, G. (2013). Strategic management. Mason, OH: South-Western, Cengage Learning.

Ireland, R., Hoskisson, R. and Hitt, M. (2008). Understanding business strategy. 2nd ed. Mason, OH.: Thomson Higher Education, p.75.

Madslien, J. (2012). Rolls-Royce sales hit new record. [online] BBC News. Available at: http://www.bbc.com/news/business-16440548 [Accessed 7 Nov. 2014].

Maguire, M. (2013). BMW Value Chain Analysis. Munich: GRIN Verlag GmbH.

Mankad, P. (2007). Selling to the globally Hyper Rich. Foreign Policy. [online] Available at: http://blog.foreignpolicy.com/posts/2007/02/06/selling_to_the_global_hyper_rich [Accessed 7 Nov. 2014].

Society of Motor Manufacturers and Traders. (2014). 2014 Automotive Sustainability Report. [online] Available at: http://www.smmt.co.uk/wp-content/uploads/sites/2/15th-Sustainability-report-final-version-3.pdf [Accessed 7 Nov. 2014].

McGuigan, J. and Moyer, R. (2010). Managerial economics. 12th ed. [Cincinnati, Ohio]: South-Western College Pub.

Muenchen, I. (2014). BMW Group posts record sales for 2013. [online] Bmwgroup.com. Available at: http://www.bmwgroup.com/e/0_0_www_bmwgroup_com/investor_relations/corporate_news/news/2014/vertriebsmeldung_januar_2014.html [Accessed 7 Nov. 2014].

Office of National Statistics (ONS) (2012). Chapter 1: Introduction and Demographics, Wealth in Great Britain 2010-12 – ONS. [online] Available at: http://www.ons.gov.uk/ons/rel/was/wealth-in-great-britain-wave-3/2010-2012/report–chapter-1–introduction-and-demographics.html [Accessed 7 Nov. 2014].

Pabst, A. (2012). The crisis of global capitalism. Cambridge, U.K.: James Clarke and Co.

Rolls Royce Motor Cars. (2014a) Rolls-Royce motor cars launches first boutique showroom [online] Available at: http://www.rolls-roycemotorcars.com/media/248397/press_release_-_rolls-royce_launches_first_boutique_showroom_en__1_.pdf [Accessed 7 Nov. 2014].

Rolls Royce Motor Cars. (2014b). Rolls-Royce Celebrates 10 Years of Excellence. [online] Available at: http://www.rolls-roycemotorcars.com/media/204955/r_r_279_rolls-royce_celebrates_10_years_of_excellence_1_.pdf [Accessed 7 Nov. 2014].

Sehgal, V. (2010). Supply chain as strategic asset. Hoboken, N.J.: Wiley.

Singh, A. (2014). Inside Rolls-Royce: where bespoke meets bling – Telegraph. [online] Telegraph.co.uk. Available at: http://www.telegraph.co.uk/motoring/news/10702547/Inside-Rolls-Royce-where-bespoke-meets-bling.html [Accessed 7 Nov. 2014].

Sperling, D. and Kurani, K. (2003). Transportation, energy, and environmental policy. Washington, DC: Transportation Research Board of the National Academies.

Telegraph.co.uk, (2014). Top 10 car makers in January – Telegraph. [online] Available at: http://www.telegraph.co.uk/finance/newsbysector/industry/9852398/Top-10-car-makers-in-January.html?frame=2420736 [Accessed 7 Nov. 2014].

Weldon, D. (2014). A UK industry driven by foreign firms. [online] BBC News. Available at: http://www.bbc.com/news/business-27414830 [Accessed 7 Nov. 2014].

![[Solved] ENGL147N - Week 7 Assignment- Final Draft of the Argument Research Paper](https://prolifictutors.com/wp-content/uploads/2023/01/Solved-ENGL147N-Week-7-Assignment-Final-Draft-of-the-Argument-Research-Paper--240x142.png)

![[Solution] - NR305 - Week 3 Discussion: Debriefing of the Week 2 iHuman Wellness Assignment (Graded](https://prolifictutors.com/wp-content/uploads/2022/06/Best-Answer-NR305-Week-3-Discussion-Debriefing-of-the-Week-2-iHuman-Wellness-Assignment-Graded--240x142.png)

![[Best Answer] NR305 - Week 2 Discussion: Reflection on the Nurse’s Role in Health Assessment (Graded)](https://prolifictutors.com/wp-content/uploads/2022/06/Best-Answer-NR305-Week-2-Discussion-Reflection-on-the-Nurses-Role-in-Health-Assessment-Graded-240x142.png)

![[Best Answer] NR305 - Week 2 Assignment: Wellness Assessment: Luciana Gonzalez (iHuman) (Graded)](https://prolifictutors.com/wp-content/uploads/2022/06/Best-Answer-NR305-Week-2-Assignment-Wellness-Assessment-Luciana-Gonzalez-iHuman-Graded--240x142.png)