Does minimum wage cause unemployment?

June 24, 2021 2021-06-24 10:04Does minimum wage cause unemployment?

Does minimum wage cause unemployment?

Introduction

According to Fanti & Gori (2013), most of the people working in America are poor because their income is below the poverty line. The main occupations in America are cashiers and salespeople with at least 8 million people having one of these two jobs which pay between 9 to 10 dollars per hour. This makes it difficult for people to make ends meet due to such wages (Sabia & Burkhauser, 2010). Despite this aspect, there has been a debate on whether an increase in the minimum wage causes unemployment. Some studies indicate that an increase in minimum wage has a significant effect on employment while others indicate that there is no or it has a small effect on employment (Lee & Saez, 2012). The negative effects on employment that are caused by the increase on minimum wage are as a result of more organizations closing and not due to firms laying off workers. On the basis of this debate on the issue on minimum wage and its effect on unemployment, this essay tries to answer the question on whether minimum wage causes unemployment.

Effect of minimum wage laws in perfectly competitive markets

According to Gorry (2013), the outcome of minimum wage is dependent on whether there is competition in the labor market or none. This results to employers applying considerable power on the decisions regarding wages. A labor market that is perfectly competitive is composed of many firms that are always competing for workers. The market determines a minimum wage that is competitive since firms have no power of setting wages. When a firm does not cooperate in paying this wage, it can either pay less which will result to it losing workers or pay more which will lead to the firm incurring losses and exiting the market.

When setting wages in a competitive labor markets, there are certain things are worth noting. In a competitive market, there are various firms that are competing for workers which mean that the market wage must be equal to the marginal product of labor (Fanti & Gori, 2013). For instance, a “marginal” worker produces goods and services worth 5 dollars within an hour. Firms can bid up to $4.50 if the market wage is $4 thus attracting workers from other firms and earn profit. If the wage of the market is higher for instance 6 dollars, firms incur losses since the cost of the workers is more than the production cost. As such, firms usually cut their payrolls in order to restore their profits. In such a case, the minimum wage for the market should be 5 dollars.

Need a paper like this one? Order here – https://prolifictutors.com/place-order/

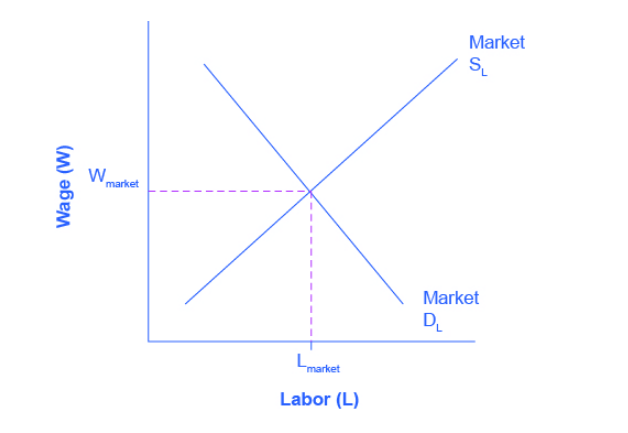

In the labor force, the highest reservation wage of workers must be equal to the market wage. Those whose reservation wage is below 5 dollars in this case stay out of labor force while those whose reservation wage is above 5 dollars enter in the labor market. In other words, there is adjustment in wages under competitive conditions thus clearing the labor market which equates labor supply to labor demand (Meer & West, 2016). The figure below shows the labor demand and supply curve in a perfectly competitive market.

Figure a: Labor demand and supply curve in a perfectly competitive market

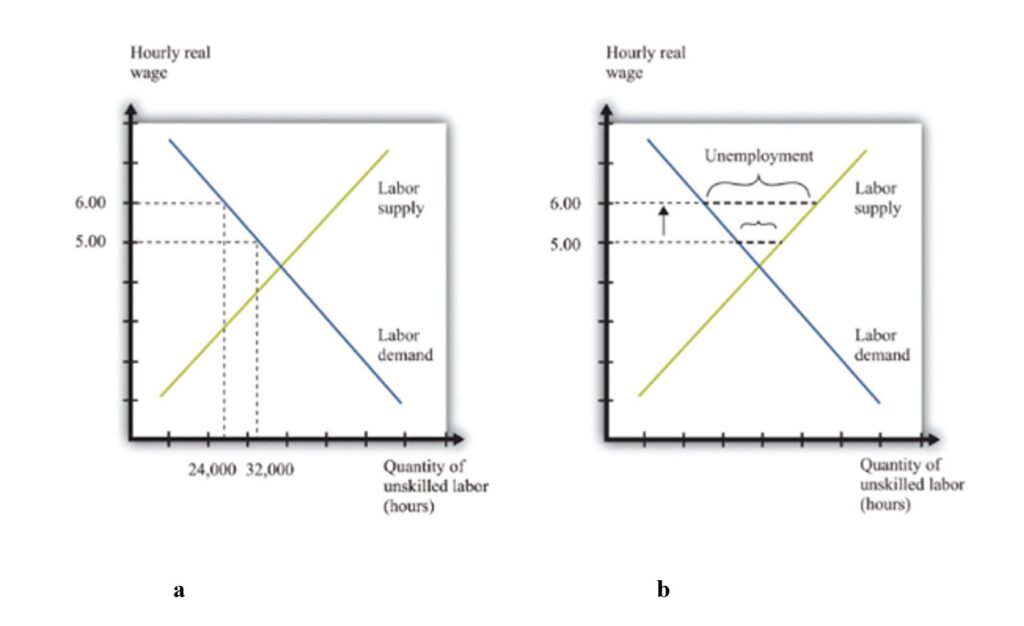

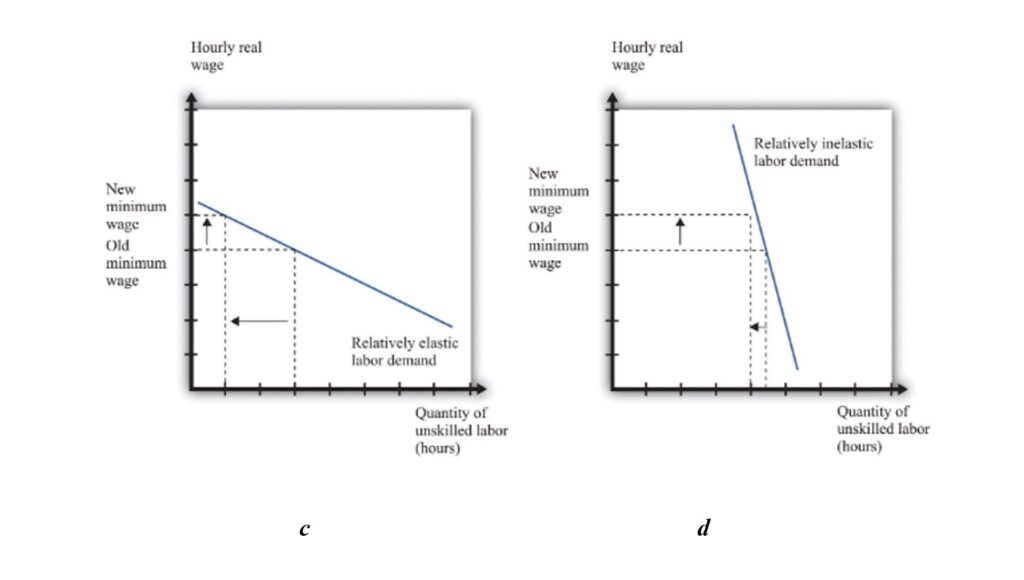

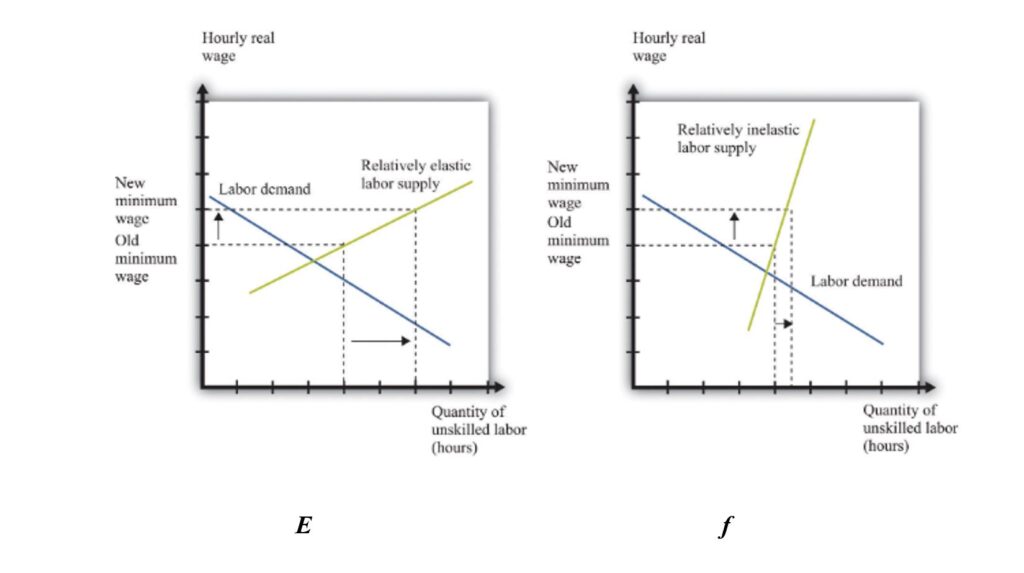

Comparison on the size of unemployment when labor supply and demand are very elastic with the results predicted when the two curves are very inelastic

It is crucial to have an understanding on when small or big changes are expected in unemployment or employment. This is dependent on the elasticity of labor demand and labor supply. Wage represents the price in the labor market thus wage elasticity is an example of elasticity of demand in prices of a given market (Alaniz, Gindling & Terrell, 2011). In the figure below, the elasticity of labor explains everything there is to be known on how changes in wages affects employment. A relatively elastic demand curve results to a large change in employment if there is a change in the minimum wage. If there is inelasticity in the labor demand curve, it results to a small change in employment when there is a change in the minimum wage. This is insightful since elasticity of labor demand shows how sensitive the hiring decisions of firms are when there is a change in wages. When the demand for labor is elastic, it means that firms will respond to the small change in wages by laying off a lot of workers thus having a large employment effect. If the concern is on employment effects the elasticity if labor supply is not usually relevant. The summary below shows different effects of changes on the minimum wage on employment.

Figure a & b: Effects of increasing the real minimum wage

Figure c & d: Employment effect of a change in the minimum wage

Need a paper like this one? Order here – https://prolifictutors.com/place-order/

However, both labor demand and supply are relevant when looking at the effect on unemployment. When someone does not have a job currently or is looking for a job, he or she is regarded as unemployed. The labor supply curve shows the number of workers that are willing to work on a certain wage, those who are looking for a job or those who are not employed (Neumark, Salas & Wascher, 2014). The mismatch between demand and supply is evaluated in order to have an understanding of the effects of minimum wage on unemployment. In the case of labor market, the responsiveness of quantity supplied to a change in the price is measured by price elasticity of supply thus obtaining wage elasticity of labor supply. When the labor supply curve is more elastic, there is a bigger change in the supply of labor for a certain change in the real wage. A bigger change in the supply of labor results to a bigger change in unemployment. If there is inelasticity in the demand and supply of labor, there is a little effect on unemployment when the minimum wage changes. The higher wage does not make much difference to hiring decisions made by firms (inelastic demand) and it does not lead to many additional workers looking for jobs(inelastic supply). Therefore, there is a small overall effect on unemployment (Lester, 2011). On the contrary, if the labor demand and supply curves are elastic, then when the wage increases, there is a big decline in the availability of jobs and a huge increase in the people looking for jobs.

Figure e & f: The unemployment effect of change in the minimum wage

In figure (e), the labor supply is relatively elastic thus a change in the minimum wage affects the unemployment with a big margin while in figure (f), labor supply is relatively inelastic a similar change in the minimum wage affects the unemployment with a smaller margin.

What happens when the minimum wage is increased in a monopsonistic labor markets

Other than a competitive market, there can be a labor market that is composed of small local markets. Some firms are in a dominant hiring position in each of the local market, for instance, there can be a retailer that is large near a small city. These kinds of markets are employer dominated and are referred to as monopsonistic market where by the main employer has the power of setting wages without fearing competition (Schmitt, 2013).

In both types of markets, (perfect and monopsonistic market) there are a lot of potential workers who have minimum wages below which they cannot work. More and more people are always willing to work as the minimum wage increases. In this case, the relationship between the number of workers who want to work for a certain amount and the market wage is called labor supply.

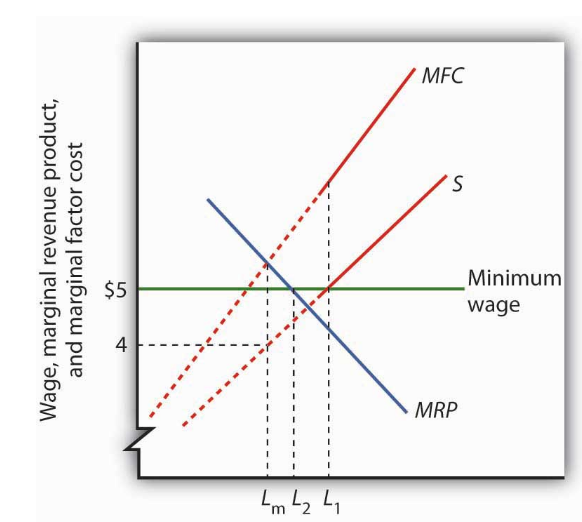

Wages are usually lower in monopsony than in similar competitive labor markets. Workers receive wages similar to their MRPs (marginal rates of productivity) in competitive markets. However, for those working in monopsony firms, their wages are less than their marginal rates of productivity (Dube, Lester & Reich, 2016). In a competitive market, employment is reduced by the imposition of minimum wage above the equilibrium wage .However, in a monopsony market; there is an increment in employment when the minimum wage is when the minimum wage is more than the equilibrium wage. Figure (a) below shows an employer in the monopsony market who is faced with a supply curve (S) from which the marginal factor cost curve (MFC) is derived. Profits are maximized by the firm by employing Lm units of labor while at the same time paying 4 dollars per hour for the wages. The wage is less than the MRP of the firm. When the minimum wage is imposed to 5 dollars per hour, the MFC curve and the dashed sections of the supply curves are irrelevant.

Need a paper like this one? Order here – https://prolifictutors.com/place-order/

Figure (a): Quantity of labor per period

In as much as the imposition of minimum wage on a monopsony market could result to increased wages and employment at the same time, this possibility is viewed as being unimportant empirically since the cases of monopsony power in labor markets are rare. However, some research has indicated that when the minimum wage is increased, it has led to either increment in employment or no significant decline in employment. This is contrary to the model of demand and supply in the competitive labor market whose predictions are that an increase in minimum wage results to an increase in unemployment due to a decrease in employment.

There was a controversy as a result of a study carried out by Alan Krueger and David Card regarding employment in New Jersey and Pennsylvania in the fast food industry. In 1992, there was an increment in the minimum wage in New Jersey to 5.05 dollars per hour when the minimum wage was 4.25 dollars per hour. The survey was carried out by the two economists in 410 fast food restaurants. There was a decrease in employment in the franchises in Pennsylvania while there was no statistically significant change in employment in the franchises in New Jersey (Khamis, 2013). This study led to the question on whether minimum wages reduce employment or not. Some of the economists indicated that results by Krueger and Card demonstrated widespread monopsony power in the labor market. Despite firms having a monopsony power, it is not possible to establish the amount of power a firm has and by how much each firm could increased the minimum wage. Therefore, in as much as it could be true that firms have monopsony power, it would not follow that it would be appropriate to increase the minimum wage.

How can economists try to find the answer to the question?

The economists: Kreuger and Card made their argument on minimum wages about two decades ago which is still the case today. Just recently in 2015, Kreuger wrote in the New York Times that when the US minimum wage is increased from 7.25 dollars currently to 12 dollars per hour by 2020, there would be more benefits than harm. The position of the economist is no longer unusual. There was a recommendation by the OECD, World Bank and IMF that governments should set minimum wages. The work of Card and Kreuger has been argued both theoretically and methodological as a result of various economists not being convinced by their monopsony explanation (Boeri, 2012).

Need a paper like this one? Order here – https://prolifictutors.com/place-order/

Assessing the impact of minimum wages is a challenging experience. The studies conducted by various economists are always contradicting in that some show harmful effects of minimum wage while others show the opposite effects. Some of the studies indicate that the increase in minimum wage affects employment while others indicate that an increase does not impact employment. However, most of the economists agree that there is a limit on how high the minimum wage can go as a way of preventing serious damage (Bosch & Manacorda, 2010). According to Kaufman (2010), there is a misconception that the economists who support the argument are pro unfettered capitalism while those who are favor of the minimum wage are pro poor. Most of the economists who do not favor the increment in the minimum wage support other policies they believe are of help to the poor without distortion of markets. For instance, increasing the income tax credit that is earned as a credit to the workers who are low income earners.

Warren Buffet who is one of the leading economists asserts that minimum wages in most cases raises unemployment since employers are given more incentive to automate and less incentive to hire and outsource tasks that had previously been performed by employees who have low wages. Higher minimum wages also result to businesses raising prices as a way of maintaining profit margins that are desired (Tonin, 2011).

Evaluation of empirical evidence and data

The impact of minimum wage is a topic that has a wide empirical literature. However, most of the studies can be classified as studies that match and those that do not match cases. The matching approach is in the case of Krueger and Card for instance whereby they concluded that there is no evidence on the minimum wage increase leading to reduction in employment (Dube & Zipperer, 2015). This is after comparison on the New Jersey and Pennsylvania restaurants. Another matching case is on Reich, Lester and Dube (2010) who compared every pair of neighboring counties with every state border in the country (Dinkelman & Ranchhod, 2012). In the matching studies there is lack of considerable effects of unemployment on the matching studies. One of the main suggestions is for employers to exercise “monopsony power” or bargaining power that is related to being one of the small populations of customers in the market. Monopsonist do absorb an increment in the minimum wage just like the way monopolists do not reduce their output in responding to reduction in prices. In as much as economists use theoretical explanations, an argument that is more straightforward is that increasing the minimum wage has no unemployment effect since increased costs in labor are distributed easily over increased productivity.

An alternative that economists use for the matching approach is using a model that is based on individual level or state-level panel data on employment levels in estimating the changes in employment after the state enacts higher minimum wage. These models contain various valuable features mostly their ability of controlling for idiosyncratic differences between individuals or states that do not change over time (Clemens & Wither, 2019). These differences are stable and are referred to as “fixed effects” thus the models are called fixed effects models. The models rely on variations in the minimum wage among states in determining the effect of the policy. David Neumark and William Wascher are the economists who are closely associated with the approach of fixed-effects model in studying the minimum wage (David & Dorn, 2013). In 1992, a typical state level fixed effects approach is offered by Neumark and Wascher which was published two years prior to the Card and Krueger study in 1994. The study indicated that an increase in the minimum wage by 10%, led to the reduction in teenage employment by 2% while that of young adults reduced by 1.5 to 2%. Further, Wascher and Neumark as well as other economists extended the framework of fixed effects modeling to individual level data in order to have an understanding of the impact of minimum wage on certain groups that were vulnerable (Allegretto & Dube, 2010). The findings indicated that in both cases an increase in the minimum wage reduced employment for the low skill workers or teenagers who were the target group.

Need a paper like this one? Order here – https://prolifictutors.com/place-order/

These studies are the best evidence on collecting empirical data that has been used in trying to match treatment cases that have appropriate control cases. The main argument is that the increase in the minimum wage does not have an impact on employment, on average. In this case, the studies indicate that increasing the minimum wages would to a large extent increase the earning of the low income families.

Conclusion

On the basis of discussion, the labor supply and demand models indicate that there may be losses in terms of welfare and employment. However, a labor market that is in monopsony state an increase in minimum wage increases the market efficiency. On the other hand, in a competitive market, an increase in the minimum wage leads to the firm incurring losses and exiting the market.

Basing on the theoretical and empirical data, there is no a clear answer as to whether minimum wage results to unemployment or not. This is because; some studies indicate that an increase or decrease in the minimum does not have an impact on employment. In this case, the argument is that an increase in the minimum wages increases the earnings of low income earners only and does not affect employment. On the other hand, there is an argument that imposing high minimum wages increases market efficiency while in some other markets it leads to losses. Therefore, there is still a debate as to whether minimum wages causes unemployment or not.

References

Sabia, J. J., & Burkhauser, R. V. (2010). Minimum wages and poverty: Will a $9.50 federal minimum wage really help the working poor?. Southern Economic Journal, 76(3), 592-623.

Lee, D., & Saez, E. (2012). Optimal minimum wage policy in competitive labor markets. Journal of Public Economics, 96(9-10), 739-749.

Gorry, A. (2013). Minimum wages and youth unemployment. European Economic Review, 64, 57-75.

Fanti, L., & Gori, L. (2011). On economic growth and minimum wages. Journal of Economics, 103(1), 59-82.

Meer, J., & West, J. (2016). Effects of the minimum wage on employment dynamics. Journal of Human Resources, 51(2), 500-522.

Alaniz, E., Gindling, T. H., & Terrell, K. (2011). The impact of minimum wages on wages, work and poverty in Nicaragua. Labour Economics, 18, S45-S59.

Neumark, D., Salas, J. I., & Wascher, W. (2014). Revisiting the Minimum Wage—Employment Debate: Throwing Out the Baby with the Bathwater?. ILR Review, 67(3_suppl), 608-648.

Schmitt, J. (2013). Why does the minimum wage have no discernible effect on employment. Center for Economic and Policy Research, 22, 1-28.

Dube, A., Lester, T. W., & Reich, M. (2016). Minimum wage shocks, employment flows, and labor market frictions. Journal of Labor Economics, 34(3), 663-704.

Khamis, M. (2013). Does the minimum wage have a higher impact on the informal than on the formal labour market? Evidence from quasi-experiments. Applied Economics, 45(4), 477-495.

Boeri, T. (2012). Setting the minimum wage. Labour Economics, 19(3), 281-290.

Bosch, M., & Manacorda, M. (2010). Minimum wages and earnings inequality in urban Mexico. American Economic Journal: Applied Economics, 2(4), 128-49.

Kaufman, B. E. (2010). Institutional economics and the minimum wage: broadening the theoretical and policy debate. ILR Review, 63(3), 427-453.

Tonin, M. (2011). Minimum wage and tax evasion: Theory and evidence. Journal of Public Economics, 95(11-12), 1635-1651.

Dube, A., & Zipperer, B. (2015). Pooling multiple case studies using synthetic controls: An application to minimum wage policies.

Dinkelman, T., & Ranchhod, V. (2012). Evidence on the impact of minimum wage laws in an informal sector: Domestic workers in South Africa. Journal of Development Economics, 99(1), 27-45.

Clemens, J., & Wither, M. (2019). The minimum wage and the Great Recession: Evidence of effects on the employment and income trajectories of low-skilled workers. Journal of Public Economics, 170, 53-67.

David, H., & Dorn, D. (2013). The growth of low-skill service jobs and the polarization of the US labor market. American Economic Review, 103(5), 1553-97.

Allegretto, S., Dube, A., & Reich, M. (2010). Do minimum wages really reduce teen employment? accounting for heterogeneity and selectivity in state panel data.

Lester, T. W. (2011). The impact of living wage laws on urban economic development patterns and the local business climate: evidence from California cities. Economic Development Quarterly, 25(3), 237-254.

Need a paper like this one? Order here – https://prolifictutors.com/place-order/

![[Solved] ENGL147N - Week 7 Assignment- Final Draft of the Argument Research Paper](https://prolifictutors.com/wp-content/uploads/2023/01/Solved-ENGL147N-Week-7-Assignment-Final-Draft-of-the-Argument-Research-Paper--240x142.png)

![[Solution] - NR305 - Week 3 Discussion: Debriefing of the Week 2 iHuman Wellness Assignment (Graded](https://prolifictutors.com/wp-content/uploads/2022/06/Best-Answer-NR305-Week-3-Discussion-Debriefing-of-the-Week-2-iHuman-Wellness-Assignment-Graded--240x142.png)

![[Best Answer] NR305 - Week 2 Discussion: Reflection on the Nurse’s Role in Health Assessment (Graded)](https://prolifictutors.com/wp-content/uploads/2022/06/Best-Answer-NR305-Week-2-Discussion-Reflection-on-the-Nurses-Role-in-Health-Assessment-Graded-240x142.png)

![[Best Answer] NR305 - Week 2 Assignment: Wellness Assessment: Luciana Gonzalez (iHuman) (Graded)](https://prolifictutors.com/wp-content/uploads/2022/06/Best-Answer-NR305-Week-2-Assignment-Wellness-Assessment-Luciana-Gonzalez-iHuman-Graded--240x142.png)