[Corporate Finance] – A professional accountancy institute in the UK is evaluating an investment project overseas in Eastasia, a politically stable country.

October 21, 2021 2021-10-21 15:49[Corporate Finance] – A professional accountancy institute in the UK is evaluating an investment project overseas in Eastasia, a politically stable country.

[Corporate Finance] – A professional accountancy institute in the UK is evaluating an investment project overseas in Eastasia, a politically stable country.

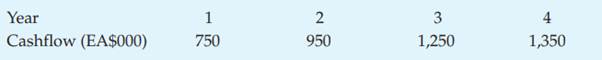

(Solved) A professional accountancy institute in the UK is evaluating an investment project overseas in Eastasia, a politically stable country. The project involves the establishment of a training school to offer courses on international accounting and management topics. It will cost an initial 2.5 million Eastasian dollars (EA$) and it is expected to earn post-tax cash flows as follows:

We have already solved this question. Get the custom answer here – https://prolifictutors.com/place-order/

The following information is available:

![]() The expected inflation rate in Eastasia is 3 per cent a year.

The expected inflation rate in Eastasia is 3 per cent a year.

![]() Real interest rates in the two countries are the same. They are expected to remain the same for the period of the project.

Real interest rates in the two countries are the same. They are expected to remain the same for the period of the project.

![]() The current spot rate is EA$2 per £1 sterling.

The current spot rate is EA$2 per £1 sterling.

![]() The risk-free rate of interest in Eastasia is 7 per cent and in the UK 9 per cent.

The risk-free rate of interest in Eastasia is 7 per cent and in the UK 9 per cent.

![]() The company requires a sterling return from this project of 16 per cent. (CIMA)

The company requires a sterling return from this project of 16 per cent. (CIMA)

Required

Calculate the sterling net present value of the project using both the following methods:

(i) by discounting annual cash flows in sterling,

(ii) by discounting annual cash flows in Eastasian $.

We have already solved this question. Get the custom answer here – https://prolifictutors.com/place-order/

![[Solved] ENGL147N - Week 7 Assignment- Final Draft of the Argument Research Paper](https://prolifictutors.com/wp-content/uploads/2023/01/Solved-ENGL147N-Week-7-Assignment-Final-Draft-of-the-Argument-Research-Paper--240x142.png)

![[Solution] - NR305 - Week 3 Discussion: Debriefing of the Week 2 iHuman Wellness Assignment (Graded](https://prolifictutors.com/wp-content/uploads/2022/06/Best-Answer-NR305-Week-3-Discussion-Debriefing-of-the-Week-2-iHuman-Wellness-Assignment-Graded--240x142.png)

![[Best Answer] NR305 - Week 2 Discussion: Reflection on the Nurse’s Role in Health Assessment (Graded)](https://prolifictutors.com/wp-content/uploads/2022/06/Best-Answer-NR305-Week-2-Discussion-Reflection-on-the-Nurses-Role-in-Health-Assessment-Graded-240x142.png)

![[Best Answer] NR305 - Week 2 Assignment: Wellness Assessment: Luciana Gonzalez (iHuman) (Graded)](https://prolifictutors.com/wp-content/uploads/2022/06/Best-Answer-NR305-Week-2-Assignment-Wellness-Assessment-Luciana-Gonzalez-iHuman-Graded--240x142.png)