Description

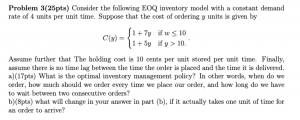

Problem 1

A decision-maker (DM) has a Bernoulli utility of wealth that is given by the function

u(w) =

{ w if w ≤ 2 3 2 w − 1 if w > 2.

This DM is considering three lotteries: Lottery A results in wealth that is distributed according to the pdf

f(w) =

{ 32 w3

if w ≥ 4 0 if w < 4.

Lottery B results in wealth that is distributed according to the pdf

g(w) =

{ 2e−2w if w ≥ 0 0 if < 0.

Lottery C results in wealth w = 1 with probability 0.5 and wealth w = 5 with probability 0.5 a) (5pts) Is the DM risk-averse? risk-neutral? or neither? Justify your answer b) (20pts) Which lottery (of the above three lotteries) does the DM prefer?

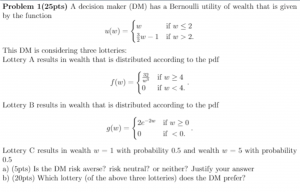

3. Problem 3(25pts)

Consider the following EOQ inventory model with a constant demand rate of 4 units per unit time. Suppose that the cost of ordering y units is given by

C(y) = {1 + 7y if w ≤ 10 1 + 5y if y > 10.

Assume further that

The holding cost is 10 cents per unit stored per unit time. Finally, assume there is no time lag between the time the order is placed and the time it is delivered.

a) (17pts) What is the optimal inventory management policy? In other words, when do we order, how much should we order every time we place our order, and how long do we have to wait between two consecutive orders?

b) (8pts) what will change in your answer in part (b), if it actually takes one unit of time for an order to arrive?

![[Solved] BIOL101 - Energy and Information - Study Guide](https://prolifictutors.com/wp-content/uploads/2022/08/Solved-BIOL101-Energy-and-Information-Study-Guide.png)

![[Solved] CSTU220 - Biographical Wiki Assignment](https://prolifictutors.com/wp-content/uploads/2022/08/Solved-CSTU220-Biographical-Wiki-Assignment-.png)

![[Solved] CCJ5285 - Week 3 Discussion - Tyler's theory, people's obedience to the law, police-citizen encounters, and Gottfredson and Hirschi's view](https://prolifictutors.com/wp-content/uploads/2022/08/Solved-CCJ5285-Week-3-Discussion-Tylers-theory-peoples-obedience-to-the-law-police-citizen-encounters-and-Gottfredson-and-Hirschis-view.png)

![[Solved] - CSTU220 Essay Assignment - Racial Reconciliation as Commanded by the Scriptures](https://prolifictutors.com/wp-content/uploads/2022/08/Solved-CSTU220-Essay-Assignment-Racial-Reconciliation-as-Commanded-by-the-Scriptures.png)

Reviews

There are no reviews yet.