Is Thomas Cook’s Tour Operation Unit Facing A Challenging Business Environment? [Essay]

January 13, 2022 2022-01-14 13:52Is Thomas Cook’s Tour Operation Unit Facing A Challenging Business Environment? [Essay]

Is Thomas Cook’s Tour Operation Unit Facing A Challenging Business Environment? [Essay]

Need a paper like this one? Order one via the form or email on our homepage.

Introduction

According to the Guardian (2013), Thomas Cook is the world’s oldest tour operator and the biggest listed tour travel company in the UK, with annual revenue of over 9 million pounds. The company also, has a widespread workforce of over 31,000 employees who play the important role of running operations in the more than 1,300 travel agencies spread across the UK. The company’s operations include “offering a range of package holidays, flights, holiday accommodation options and associated services both through its own and third party travel agencies and direct consumers” (Great Britain: Competition Commission, 2012, p. 7). The company has a number of brands in the UK which it uses to carry out leisure travel activities in the UK. Such brands include Thomas cook, going places, air tours among others. It also operates an airline used primarily for facilitating holiday packages.

A study conducted by the European tourism market, points out the changing nature of the tourism service provision market, increased similarity of services offered by travel companies and technological developments and how they have narrowed down profits and have, consequentially, caused the emergence of ruthless competition among the current players (Sezgin, 2008). To this extent, this paper seeks to provide an environmental analysis of Thomas Cook in the context of the UK market. To achieve this, the report employs PESTEL analysis – an analysis of political factors, economic factors, socio-cultural factors, technological factors, environmental factors and legal factors – and its impact on the performance of the company.

PESTEL Analysis

According to Evans and Richardson (2007) an environmental analysis should identify any key external factors that require some form of organisational action. Additionally, the two authors support the use of the PESTEL framework in analysing business environment. The framework, as aforementioned, categorises environmental factors into; political, social-cultural, technological, environmental and legal.

Political factors

The UK government has a stable political environment based on democracy and a strong position in the global politics that has enabled it to become a business hub. It enjoys warm relations with its neighbors. In addition, since the 7/7 bombings in 2005 at a public transport system in London, the government has implemented policies such as the Terrorism Act of 2006 to narrow the possibilities of future occurrences (Kerr-Ritchie, 2011). However, this does not eliminate risks of future attacks as the UK involvement in Afghanistan causes enmity between the two nations. Firms operating in the tourism industry are therefore faced by uncertainty of demand due to security speculations. However, future prospects of stronger ties with other nations such as china also offer firms within the tourism industry with broader opportunities to expand. This means that as firms take over new markets, the players in the UK market may be less and the competition level in the UK will reduce.

Economic factors

Among the EU nations, the UK has the highest level of per capita income. Furthermore, the UK economy is the largest economy among the EU nations and a report by the World Bank on favourable places to do business in, the UK ranks as number ten. This means that the UK has a favourable economy for business for a firm such as Thomas Cook to run. Top among the strengths is the UK’s economy, according to the report, are the availability of skilled labor and a flexible regulatory system which favours firms in meeting the long term capital requirement goals (World Bank, 2014). . The UK also spots a lower corporation tax rate and compliance costs compared to its neighbor. For example, tax rates in the UK are 34% against European Union’s average of 41.1% (PricewaterhouseCoopers, 2014). The implications of this include a favorable environment for businesses to operate in.

Social-cultural factors

Statistics on the population in the United Kingdom indicate an ageing population. In the country census conducted in 2009, for the first time in history, the number of people aged over 60 years was more than those aged below 16 years (Kinsella and He, 2009). Additionally, the working population is projected to be in a crisis soon because as per the 1900s for every retired worker, there were 22 people of working age but a projection to 2024 shows there will be only three. The tourism industry is therefore facing a major issue in regard to procuring labour services given that the working conditions in the industry are not lucrative. However there is a bright side to the aging population; over 80% of the holiday cruises are bought by people over 50 years (news.bbc.co.uk, 2014). This means that over the years the demand for tour and travel services in the UK will increase.

Technological factors

The internet has been a powerful in revolutionalising the way firms conduct business. According to Garces et al (2002), the consumers have always demanded a great value form the providers of tourism packages and the internet presented a dynamic way of acquiring information on offers and accessing services instantly, cheaply and interactively. The tourism industry has necessitated firms to embrace the use of social media for advertisement, customer care and general distributions of products and services. Thomas cook, for example, launched a platform where customers can book a holiday package at an agent and then manage it online. According to the Monaghan (2013), Thomas cook wants to attain over 50% of its bookings over the internet. However, there is still more to be done because the internet keeps developing and presenting new platforms such as the emergence of Smartphones and Smartphone applications.

Environmental factors

The UK, being a major player in the world economy, plays an imperative role in the implementation of policies concerning environmental awareness. In 2011, for example, the implementation of the Energy Act 2011 changed the provisions for homes and businesses regarding carbon emissions in the UK (United Kingdom. Department of Energy and Climate Change, 2011). The government is also faced by a great challenge of increased carbon and nitrogen emissions in especially in the capital, London (Beevers et al, 2013) and monitors companies keenly to monitor their emission levels as per the Environmental Protections Act of 1990. As a result, the business community should expect even more stringent policies and laws regarding toxic emissions. Such environmental policies mandate a firm such as Thomas Cook to employ latest technologies on waste disposal and be keen on their impact on the environment.

Legal factors

There are a number of laws in the UK that govern how firms should run their activities and the extent of their responsibilities. The Consumer Protection Act of 1987 does, for example, requires a firm to be liable to the consumer for any damage, injury of loss caused by a defective product (Deards and Twigg-flesner, 2001). In the tourism industry the extent of application can range from hotels, airline services and even road transport. A firm such as Thomas Cook therefore has enormous responsibility to ensure quality and standards are met in order to avoid huge losses in terms of liabilities to customers. Other laws include the Sale of Goods Act, Supply of Goods Act and the recent Consumer Protection from Unfair Trading Regulations, 2008. Despite this, the UK ranks high among the nations with flexible regulatory framework in business; it was ranked among the top in consideration of legal freedom (World Bank, 2014)

Porter’s five forces

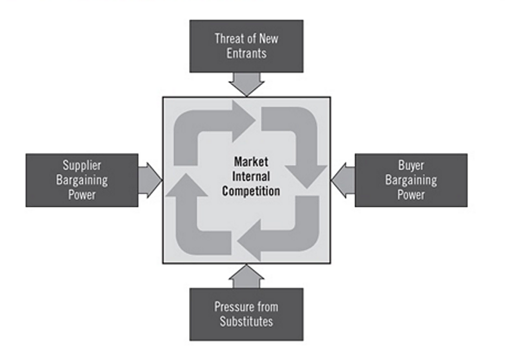

Porter’s five forces framework was created to help describe the competitive forces in a market economy (Monczka, Handfield and Trent, 2011). The model is used for ensuring that sales and marketing strategies are sound and for business strategy development. Figure 1 below illustrates the five forces that shape the industry according to Michael Porter.

Figure 1: An illustration of Porter’s five forces Model (Monczka, Handfield and Trent, 2008).

Threats of new entrants

Thomas Cook enjoys a brand that has been around for years; therefore, it boasts of customer loyalty across the UK (Ian, 2013). Entry of new firms into a new market is significantly affected by brand loyalty being enjoyed by existent firms. This is mainly because customers are more rigid in terms of shifting from a brand they have been loyal to, to an entry brand. Additionally, the initial investment costs of entry into the tours and travel industry – such as establishment of company airlines, building hotels and acquiring cruise fleets – are enormous. The high costs discourage potential entrants from investing in the tours and travel industry. Government regulatory frameworks also pose a challenge to new entrants. For example, taxes in the tourism industry exist at local, national and European levels. Compliance with all this taxes and regulations demand considerably huge employment of resources which is a heavy burden to bear (ECORYS Research and Consulting, 2009). The threat of entry is, therefore, low.

Bargaining power of buyers

Thomas Cook’s main market is concentrated in the UK and Europe region (ECORYS Research and Consulting, 2009). The firm, therefore, experiences considerable bargaining power of buyers given it cannot afford to lose the market share it currently holds. Customer switching to other brands could affect the firm more adversely than the same scenario for competitors like TUI who operate internationally; they do not rely on the UK only. The presence of these competitors who offer the same products (undifferentiated) as Thomas Cook also, grants buyers more bargaining power. They also lower buyer switching costs between services offered by the travel companies. Buyer bargaining power is thus high.

Pressure from substitutes

As mentioned above, Thomas Cook’s market in concentrated in Europe and the UK and more specifically in five countries; UK, Spain, Italy, France and Germany. Substitutes in this market region are many include TUI holdings, Carlson Wagonlit Travel, Virgin Atlantic and Kuoni Travel Holdings which are among the 78,000 enterprises operating in Tour and Travel Industry (ECORYS Research and Consulting, 2009). All these firms offer substitute holiday packages at competitive costs. The pressure of substitutes is thus high.

Supplier bargaining power

Suppliers in the Tour and Travel industries refer to hotels, transport companies – both airline and road –, and holiday destinations. One of Thomas Cook’s strength against the suppliers is backward and forward integration. Through vertical integration – an airline, an outbound tour operator and travel agents –, the company has turned into its own supplier in some areas such as transport and hotels. For example, the company owns airplanes and hotels (directline-holidays.co.uk, 2014). Consequently the firm has a better bargaining leverage against suppliers. The supplier bargaining power for Thomas Cook is thus considerably low in comparison to competitors.

Rivalry among existing firms

Competition is high in the UK’s tourism industry with over 78,000 operational enterprises as per 2010 (ECORYS Research and Consulting, 2009). Thomas Cook, however, has effectively eliminated competition over the years through horizontal integration. Two mergers – with co-op travel and Mytravel – and several acquisitions in the recent years has seen it remain with one major rival; TUI holdings. An imperative point to note though is that competitors its competitors such as TUI and Virgin Tours have also adopted the integration method and although it makes entry of new firms into the industry difficult, it creates room for more competitive rivalry (Coles and Hall, 2008). Competition for Thomas Cook is so tight that it has had to dispose off assets and diversify its portfolio into lending so as to stay afloat in the industry; the firm, however, remains a competitive in the provision of tour and travel services ranking among the top (Scuffham, 2012).

References

Coles, T. and Hall, C. (2008) International Business and Tourism: Global Issues, Contemporary Interactions. USA: Routledge.

Directline-holidays.co.uk, (2014) Thomas Cook Holidays. [online] Available at: (http://www.directline-holidays.co.uk/tour-operators/thomas-cook-holidays [Accessed 17 Nov. 2014].

ECORYS Research and Consulting, (2009) Study on the Competitiveness of the EU tourism industry. Framework Contract of Sectoral Competitiveness Studies. Rotterdam, Netherlands.

IAN, T. (2013) Cooks Commands Loyalty. Travel weekly, (2155), p.72.

Monczka, R., Trent, R. and Handfield, R. (2011) Purchasing and supply chain management. 2nd ed. Australia ; United Kingdom: South-Western.

Scuffham, M. (2012) Thomas Cook says holds market share vs rival TUI. [online] Uk.reuters.com. Available at: http://uk.reuters.com/article/2012/02/08/uk-thomas-cook-idUKTRE8170LV20120208 [Accessed 17 Nov. 2014].

Beevers, S., Kitwiroon, N., Williams, M., Kelly, F., Ross Anderson, H. and Carslaw, D. (2013) ‘Air pollution dispersion models for human exposure predictions in London’, Journal of Exposure Science and Environmental Epidemiology, 23(6), pp.647-653.

Evans, C. and Richardson, M. (2007) ‘Strategy in Action Assessing the Environment’, British Journal of Administrative Management, (60), p.I-III.

Deards, E. and Twigg-flesner, C. (2001) ‘The Consumer Protection Act 1987: proof at last that it is protecting consumers’, Nottingham Law Journal, 10(2), pp.1-19.

Garcias, S., Gorgemans, S., Martinez Sanchez, A. and Parez Parez, M. (2004) Implications of the Internet an analysis of the Aragonese hospitality industry, 2002. Tourism Management, 25(5), pp.603-613.

Great Britain: Competition Commission, (2012) A Report on the Anticipated Travel Business Joint Venture Between Thomas Cook Group Plc, the Co-operative Group Limited and the Midlands Co-operative Society Limited. Norwick, UK: The Stationery Office, pp.7-9.

Kerr-Ritchie, J. (2011) 9/11 and the United Kingdom. Radical History Review, (111), pp.203-209.

Kinsella, K. and He, W. (2009) An Aging World: 2008. International Population Reports. Washington, DC: U.S. Government Printing Office.

United Kingdom. Department of Energy & Climate Change, (2011) Energy Act 2011. [online] Available at: http://www.legislation.gov.uk/ukpga/2011/16/contents/enacted [Accessed 13 Nov. 2014].

Monaghan, A. (2013) Travel agent Thomas Cook makes first profit since 2010. [online] the Guardian. Available at: http://www.theguardian.com/business/2013/nov/28/thomas-cook-first-profit-holiday [Accessed 17 Nov. 2014].

News.bbc.co.uk, (2014) BBC NEWS | Programmes | If | Ageing population: Facts behind the fiction. [online] Available at: http://news.bbc.co.uk/2/hi/programmes/if/3493352.stm [Accessed 17 Nov. 2014].

PricewaterhouseCoopers, (2014) Paying Taxes 2014: The global picture. Doing Business. Washington DC: World Bank Group, pp.1-164.

Sezgin, E. (2008) ‘Brand image management: Perceptions of European tour operators in single tourism market concept’, Tourism; Preliminary Communication, 56(2), pp.173-183.

The Guardian, (2013) Thomas Cook shares hit as UK summer bookings fall. [online] Available at: http://www.theguardian.com/business/2013/sep/26/thomas-cook-shares-uk-summer-bookings-tui-travel [Accessed 17 Nov. 2014].

World Bank, (2014) Doing Business 2014; Understanding Regulations for Small and Medium-Size Enterprises. Washington DC: World Bank Group, p.3.

![[Solved] ENGL147N - Week 7 Assignment- Final Draft of the Argument Research Paper](https://prolifictutors.com/wp-content/uploads/2023/01/Solved-ENGL147N-Week-7-Assignment-Final-Draft-of-the-Argument-Research-Paper--240x142.png)

![[Solution] - NR305 - Week 3 Discussion: Debriefing of the Week 2 iHuman Wellness Assignment (Graded](https://prolifictutors.com/wp-content/uploads/2022/06/Best-Answer-NR305-Week-3-Discussion-Debriefing-of-the-Week-2-iHuman-Wellness-Assignment-Graded--240x142.png)

![[Best Answer] NR305 - Week 2 Discussion: Reflection on the Nurse’s Role in Health Assessment (Graded)](https://prolifictutors.com/wp-content/uploads/2022/06/Best-Answer-NR305-Week-2-Discussion-Reflection-on-the-Nurses-Role-in-Health-Assessment-Graded-240x142.png)

![[Best Answer] NR305 - Week 2 Assignment: Wellness Assessment: Luciana Gonzalez (iHuman) (Graded)](https://prolifictutors.com/wp-content/uploads/2022/06/Best-Answer-NR305-Week-2-Assignment-Wellness-Assessment-Luciana-Gonzalez-iHuman-Graded--240x142.png)